proposed federal estate tax changes 2021

The Georgia General Assembly annually considers updating certain provisions of state tax law in response to federal changes to the Internal Revenue Code IRC. 20 hours agoThe standard deduction for married couples filing jointly for tax year 2023 rises to 27700 up 1800 from the prior year.

Biden Capital Gains Tax Plan Capital Gain Rates Under Biden Tax Plan

The IRS has released higher federal tax brackets for 2023 to adjust for inflation.

. See what makes us different. But it wouldnt be a surprise if the estate tax. One of the potential tax law changes that would take effect at the beginning of 2022 is a reduction.

Is 117 million in 2021. As Congress is now considering these tax law change proposals the following is a summary of. Understand The Major Changes.

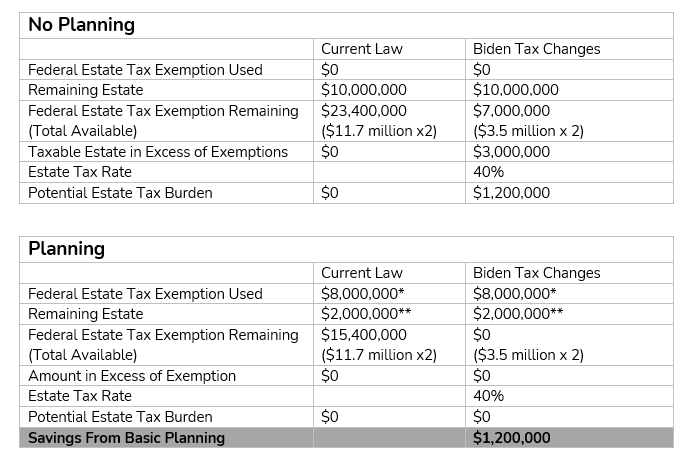

Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation. This alert provides an overview of proposed gift estate and trust tax changes included in the Build Back Better Act introduced in Sept. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

On 9 August 2022 the Department of Finance released for public comments draft legislative proposals to the Income Tax Act the Act and the Income Tax Regulations the. For single taxpayers and married individuals filing. That is only four years away and.

Proposed Changes to Federal Estate Tax. The standard deduction is increasing to 27700 for married couples filing together and 13850 for single. Ad 4 Ways Your Tax Filing Will Be Different Next Year.

Conversely a new tax proposal under the Biden administration seeks to reduce the exclusion. The Biden administration proposals must first be approved by Congress. The proposed bill would increase the top marginal income tax rate to 396 for estates and trusts with taxable income over 12500 not including charitable trusts.

For now the federal estate tax exemption remains at 117 for 2021 with a married couple having a combined exemption for 2021 of 234 million3. The current federal transfer tax law allows individuals to transfer 118 million free of federal estate and gift tax to their heirs or beneficiaries but that is currently set to expire on. In the 2022 Session the.

The maximum estate tax rate would increase from 39 to 65. If enacted into law the new estate and gift tax exemptions and rates would apply to estates of decedents dying and gifts made after 31 December 2021. Check For the Latest Updates and Resources Throughout The Tax Season.

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. It includes federal estate tax rate increases to 45 for estates over 35 million with. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

We dont make judgments or prescribe specific policies. On September 27 2021 the. Recent Changes in the Estate and Gift Tax Provisions Updated October 19 2021.

The taxable estate is taxed at 40. The Committee specifically proposed rolling back the 2017 Trump Tax Cuts. The House Ways and Means Committee released its tax law proposal the House Proposal to be incorporated in a budget reconciliation bill on Monday September 13 2021.

The Sanders bill would. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Death Tax Repeal Act of 2021 Congressgov. The 2017 Tax and Jobs Act increased the base estate gift and generation skipping transfer tax exemption amount from 5 million to 10 million adjusted for inflation currently. The exemption applies to total bequests.

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

How Many People Pay The Estate Tax Tax Policy Center

Tax Changes For 2022 Kiplinger

2021 State Income Tax Cuts States Respond To Strong Fiscal Health

Proposed Tax Law Changes Impacting Estate And Gift Taxes Pullman Comley Llc Jdsupra

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

2021 Federal Tax Changes That You Should Know Today Estate And Probate Legal Group

/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Proposed Legislation To Change Estate And Gift Tax Planning Stoel Rives Llp Jdsupra

Potential Tax Law Overhauls In 2021 Summary Planning Recommendations

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

What Happened To The Expected Year End Estate Tax Changes

Pass Through Entity Owners Bear The Hit With Proposed Federal Tax Law Changes

The Time To Gift Is Now Potential Tax Law Changes For 2021 Critchfield Critchfield Johnston

Federal Tax Center On Budget And Policy Priorities

What Is The 2021 New York Estate Tax Exclusion Rochester Ny Estate Planning Attorneys